|

Is the United States Wal-Marching Off the Cliff???

A Citizen's Guide to the Wal-Martization

of the American Economy

December 18, 2004

Comment #532

Attached References:

[Ref.1] Simon Head "Inside the Leviathan," New York Review of Books, Volume 51, Number 20, December 16, 2004

The book review by Simon Head in Reference 1 below is a devastating indictment of the harsh labor practices of America's largest and "most successful" corporation. But there are many other hidden costs to the Wal-Mart Economic Model. Note how Wal-Mart's predatory practices are increasing the welfare burdens of federal and state governments, in effect creating an invisible government subsidy to Wal-Mart.

Mr. Head's excellent essay focuses on labor practices, but consider what is not discussed: Wal-Mart's economic power and predatory pricing practices put pressures on US suppliers that contribute materially to the declining manufacturing base in America. Wal-Mart is now the nation's foremost importer of manufactured foreign products (particularly from China), and it is using its market power to squeeze American manufacturers to match Chinese prices. This unrelenting pressure induces U.S. producers to move production overseas, thereby reducing the manufacturing base in the United States and forcing more middle class production workers to sink into low paying consumption industries like Wal-Mart.

Wal-Mart is based on economic model that makes a bad situation much worse.

To see why, let's construct a simple merchandise trade report card for our nation:

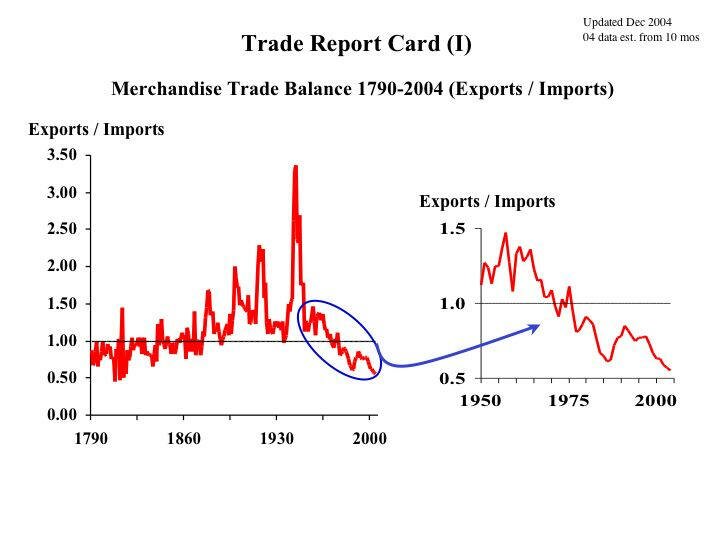

Trade Report Card (I) below shows the history of the balance in trade for merchandise exports and imports for the entire history of the United States from 1790 to December 2004. The trade balance trended toward improvement between 1790 and about 1950, but since 1950 the long-term trend has been one of steady deterioration.

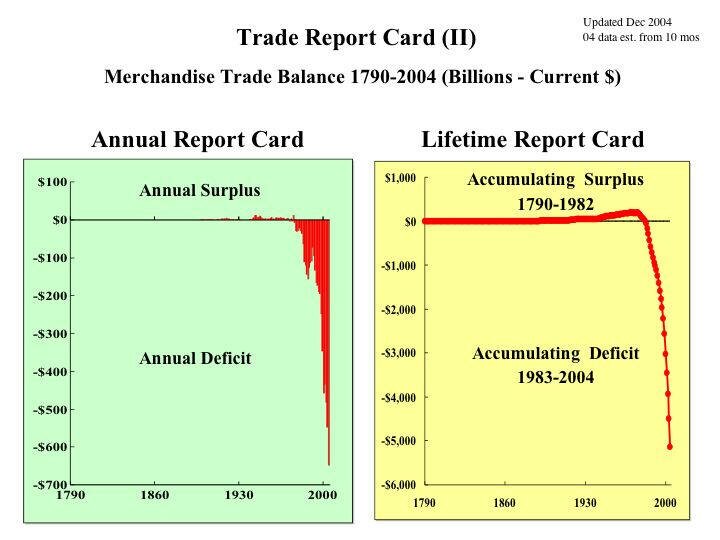

But there is more. Over the time span under consideration, the volume of trade has grown exponentially. Trade Report Card (II) puts this growth into perspective. The chart on the left shows the balance of merchandise trade in dollars over time. The effects of inflation are included (it can not be reliably removed), but since older dollars are worth more than newer dollars, this analytical limitation serves to understate the size of the change from surplus to deficit (i.e., the real, or inflation-adjusted, trend would be far worse than depicted). The chart on the right sums up the report card by showing a running score, that is to say by accumulating all the balances since 1790 and today into an accumulating time series — again in current dollars and therefore again underestimating the magnitude of the change from surplus to deficit.

Obviously, Wal-Mart did not start and certainly is not solely to blame for a trade problem with such deep roots. Indeed, much of the deterioration predates Wal-Mart's existence. But Wal-Mart, the world's largest corporation, is an economic model that reflects this trend. Even worse, Wal-Mart is an economic monster that thrives and grows by magnifying a long-term trend that is clearly out of control and unsustainable.

Also not addressed in Head's excellent essay is other side of the supply-demand relationship: a rampant consumerism inspired by a price gouging, mass marketing "Wal-Mart-ethos" (masses of people getting in line at 3AM to be first in a Christmas sale) that reinforces a materialistic consumption culture where everything is on "sale" (even when it is not). It is a culture that induces people to save less in an economy that does not save enough to fix its declining industrial base, let alone pay for the economic effects of an aging population, the debt-growth produced by importing more than we export, and a federal deficit/debt burden that is spiraling out of control.

The result is a diabolical interaction of impoverishment and consumerism that creates a deadly feedback loop wherein unbridled consumerism feeds deindustrialization which leads to low wage service employment with more worker exploitation, and even lower wages, while wealth gets more and more concentrated in the hands of a greedy elite that using the fiscal and trade imbalances to enrich itself. No doubt, this social evolution is being lubricated by the dumbing down of the American masses hooked on "reality TV" and non-reality news, not to mention the know-nothingism of a politically correct education system (where, for example, the overwhelming evidence supporting scientific theories like evolution can be dissed as unsubstantiated hypotheses in the interests of "fairness" to opposing speculations without a comparable scientific foundation)

Sooner or later, the whole mindless interaction of "greed begets greed" will evolve into into a stasis, a kind of economic sludge, where the unbridled consumerism of the increasingly impoverished working poor can not generate enough money to keep predatory monsters like Wal-Mart afloat.

Even Henry Ford appreciated the limits posed by this kind of problem when he realized there would never be a large market for the Model T cars as long as he kept his workers' production wages at poverty levels. That is why had the foresight to increase the wages of his assembly line workers.

Yet the Bush Administration clings to the Pollyanna view that letting the price of dollars fall in relation to other currencies will solve this problem, while it is running deficits that must be financed by international lenders.

Am I nuts????? Perhaps living on a sailboat and cleaning out marine toilettes has colored my outlook.

So, I asked my good friend, the ever dispassionate Werther, for his views on the question of whether or not the de-industrializing heirs of Sam Walton will exhibit Henry Ford's foresight and pull America back from the cliff.

His response.

Rolling Snake-Eyes

The American Citizen's Guide to Wal-Martization

by Werther*

Chuck Spinney's introduction to a newspaper piece critical of Wal-Mart correctly identifies the Wal-Mart phenomenon as a component of larger political, economic, and social trends in the United States. These trends deserve elaboration.

First, our elites use the buzz-word "globalization" to describe the Wal-Martization of the U.S. economy in an attempt to "frame," or propagandize, the issue. The intent is to make the public think the process of outsourcing, de-industrialization, and wage cutting is an organic, inevitable, and irreversible process, much like evolutionary biology which in an ironic twist the otherwise credulous public now derides.

It is nothing of the kind. Wal-Martization is part of a deliberate effort to shift the U.S. system from an industrialized economy to a financialized one. At some point in the recent past (possibly the 1980s or 1990s) the American financial sector became bigger than the nominal U.S. government – in assets probably, in its capacity to dictate events most certainly.

The mileposts on the road to Wal-Martization are the Garn-St.Germain Depository Institutions Act, the collapse of Resale Price Maintenance, NAFTA, WTO, The Securities Litigation Reform Act of 1996 (possibly the most corrupt and transcendently awful statute since the Volstead Act), and the repeal of the Glass-Steagall Act. This is but a partial list of enabling laws; a complete one would exhaust available bandwidth.

Briefly put, for the new CEO class, the difference between industrialism and financialism is the difference between being a ditch digger and a casino operator. The ditch digger may create real value in the physical economy — by building an aqueduct, subway tunnel, or similar piece of infrastructure — but his work is arduous and remuneration is limited by supply of and demand for labor. The casino operator, by contrast, creates no new real wealth, but merely redistributes it from the many to the few. But the casino operator's transaction fee is large and calculable by statistical laws.

While that analogy may seem a grotesque exaggeration, the unregulated banker is in a position similar to that of the casino operator. Contrary to Alan Greenspan's hocus-pocus pronouncements, banks, whether central, commercial, or investment, only create real wealth if they strategically allocate available savings to wealth-producing activities in the real physical economy.

But this is a tiresome activity requiring great expertise and some measure of luck. For two centuries, bankers have been beset by the business cycle; the inevitability of declining profit margins as formerly new technologies matured; and overcapacity. The banker's dreams of avarice were further deflated by national regulations creating fire walls between commercial and investment activities (this was done to prevent bank panics; i.e., to protect the banker from the adverse consequences of his own or his colleagues' folly); prohibition of ownership of industries (to avoid cartelization, i.e., fascization of the economy a la Alfried Krupp von Bohlen und Halbach-Siftung,); usury laws (credit cards holders need no explanation of that); and regulations requiring the honest booking of assets.

Clearly, a casino economy operating for the benefit of the bankers was preferable. They could create the illusion of wealth through asset inflation: be it Texas real estate prior to the S & L collapse; derivatives (which have a fictive value in the tens of trillions of dollars); Russian GKOs (Ruble-denominated securities); the dot.com bubble (whose growth was said to undergird the new economy wherein the business cycle was abolished, but whose collapse has left high-tech workers with an unemployment rate above the national average); and once again the current real estate mania.

At the same time, the bankers were determined to solve the problem (as they saw it) of excess capacity and cyclical declining profits in industry by the simple expedient of liquidating industry. Henry Ford's dilemma - he could not increase car production unless his workers could afford to buy the cars they produced - might be solved simply by offshoring production to starvation-wage countries. If ten-year-olds were worked to death in a Thai sweat shop, that was the Thai government's problem. It was a magical solution to declining profits. [1]

Because a healthy manufacturing sector in the United States was superfluous, everything else followed: a defined benefit pension, the hallmark of a civilized society, was simply unaffordable. NAFTA and WTO guaranteed that result. Likewise, employer-provided health care. No U.S.-based industry could conceivably compete with dollar-an-hour labor under those circumstances. The disparity in purchasing power parity between the United States and, say, Vietnam, was such that domestic production, even without pension benefits and health care, but especially with them, became economically nonsensical. Perhaps this is the reason China now makes as much steel as the United States and Japan combined, and pours three times as much concrete as the Sole Remaining Superpower.

Enter Wal-Mart. To avoid troublesome consequences of de-industrialization, such as rioting, looting, and (Heaven forefend) holding elected official accountable, the elites required a mechanism to make staples at least barely affordable to the newly proletarianized working class. It is no coincidence that those who work at Wal-Mart can afford to shop only at Wal-Mart. Both their purchasing power, and those who formerly worked at domestic retail suppliers of Wal-Mart, are pegged to the international standard: the lowest prevailing wage.

One of Wal-Mart's solutions, unmentioned in most analyses of its business practices, is not merely to demand that its U.S. suppliers relocate production offshore for price reasons, preferably in China; it is to insist on a binding contract whereby the resulting export platform produces its wares only for Wal-Mart. This would be a blatant conspiracy in restraint of trade under applicable U.S. statute, which suggests the urgency of Wal-Mart's desire to relocate its suppliers in a territory where Elliot Spitzer's writ does not reach. The Chinese government for its part is notably tolerant of such practices, providing its surplus population is employed. [2]

And so the moving hand, having writ its mark upon the sands of time, moves on. It is a phenomenon one would believe, merits public mention as much as the progress of the Laci Peterson trial or vulgar gyrations of the winning contestant of American Idol. But one would be wrong.

The current orchestrated pseudo-debate over Social Security "reform" is intimately related to the Wal-Mart phenomenon: the question lies before us: should the multi-trillion dollar cash flows of a national program for social insurance to the elderly and disabled pass through the hands of mutual fund managers? Would it improve the actuarial soundness of the system if these selfless individuals extracted a 50-percent transaction fee on "private" accounts, as has been the case in Chile? Here again, the financialization of the U.S. economy becomes manifest.

From decades of close observation of the prehensile anthropdoedia who constitute the American political class, we can candidly report that the cover story for Social Security "reform" is bunk. The prevailing explanation of the necromancers who perform on Capitol Hill and Pennsylvania Avenue is that Social Security will go broke: in 2042, according to the actuaries who sweat under the lash of the incumbent administration, after 2050, according to the Congressional Budget Office.

That stipulated, is it credible that the ward heeler class should suddenly become concerned about a problem that will emerge when most persons capable of reading this bill of indictment are safely dead? Politicos are notorious for disregarding any issue that emerges in a period of time greater than two weeks hence. Are there not problems more pressing? A moment's thought suggests a few issues of more immediate urgency:

-

A national debt (i.e., deferred taxation) which is large, growing, and bodes to make China and Japan America's paymaster. Social Security "reform" would increase that debt by at least a trillion dollars, and transform the Chinese and Japanese governments into our social insurance underwriters.

-

A "defense" budget which threatens to bankrupt the country even as it makes the United States less safe.

-

A Medicare system which will become insolvent in the next decade, a bankruptcy whose insolvency date was speeded up by the passage of a prescription drug benefit (i.e., a subsidy to the pharmaceutical industry, which has shown noteworthy generosity to politicians willing to transform themselves into human megaphones announcing the virtues of a drugged existence).

-

An immigration regime that is out of control. This policy rewards those businesses (Wal-Mart itself, agribusiness, the construction trade and other sectors which make generous contributions to politicians willing to reduces their wage bills. It is an unremarked irony that an incumbent administration which encourages xenophobia ("freedom fries," "ragheads," and similar adolescent outbursts) and practices unilateralism in foreign policy, nevertheless has advanced a proposal to amnesty as many as10 million immigrants. Wall Street is evidently a hard task master.

-

An oil policy which rewards consumption at the expense of production or conservation, even as the major oil fields are reaching their peak and approaching decline. The incumbent administration’s plan to confiscate the second largest pool of oil yet discovered ("Operation Iraqi Freedom") was horribly botched and has succeeded in taking a major source of energy virtually off line.

History admits of no inevitabilities. The upward trajectory of so-called progress since the Enlightenment may be an illusion, easily negated by an upwelling of popular delusion (conveniently disguised as religious conviction), and the more rational calculation of those few who profit. The common folk who believe they may be snatched at any moment by their scapulae and hauled up to the Eternal Kingdom do not suspect that in this temporal life, they are considered expendable by those who advocate the social kind of Darwinism even as they repudiate the scientific variety. These poor folk, our fellow citizens – if the term "consumers" has not usurped "citizens" – are the new American equivalents of denizens of the Brazilian favelas.

Present and future American replicates of the Brazilian model may die in Fallujah or Ramadi (or Teheran or Damascus), or they may be dropped on the scrap heap of obsolete labor. But their rulers will live in gated communities, and, if driving becomes too dangerous, will fly over the slums in private helicopters as is now the custom of the rich in Rio de Janeiro or Sao Paulo. For the faithful, huddling in their dwellings in Flint, Gary, Camden, or East Los Angeles, there will always be pie in the sky, by and by: available at Wal-Mart.

* Werther is the pen name of a Northern Virginia-based defense analyst.

[1] Those who regard allegations of slave labor as hyperbole will be interested to know the oil firm Unocal has just now settled a lawsuit alleging use of slave labor and forced displacement of local populations in the construction of a pipeline in Burma. "Unocal to Settle Rights Claims," The Washington Post, 14 December 2004, p. E-2.

[2] The sum of collapsing U.S. manufactures and exploding imports is the merchandise trade deficit, which has now reached $500.5 billion in only the first 10 months of 2004, exceeding the record for all of 2003. "U.S. Trade Deficit at Fresh Record," Moneyweb, 14 December 2004. It may only be a coincidence, but the trade deficit, the budget deficit, and the military budget inclusive of war supplementals are each trending towards the half-trillion dollar range. Economists have not fully explored the interdependency of debt finance, de-industrialization, and social substitutes for manufacturing such as military spending.

Chuck Spinney

"A popular government without popular information, or the means of acquiring it, is but a prologue to a farce or a tragedy, or perhaps both. Knowledge will forever govern ignorance, and a people who mean to be their own governors must arm themselves with the power which knowledge gives." - James Madison, from a letter to W.T. Barry, August 4, 1822

[Disclaimer: In accordance with 17 U.S.C. 107, this material is distributed without profit or payment to those who have expressed a prior interest in receiving this information for non-profit research and educational purposes only.]

Reference 1

Inside the Leviathan

By Simon Head

New York Review of Books

Volume 51, Number 20

December 16, 2004

http://www.nybooks.com/articles/17647

Review

BOOKS AND DOCUMENTS MENTIONED IN THIS ARTICLE

Wal-Mart: Template for 21st Century Capitalism?

edited by Nelson Lichtenstein

Papers presented at a conference on Wal-Mart held at the University of California, Santa Barbara, April 12, 2004.

New Press, forthcoming in 2005

US Productivity Growth, 1995-2000, Section VI: Retail Trade a report by the McKinsey Global Institute

October 2001, at www.mckinsey.com/knowledge/mgi/productivity

Selling Women Short: The Landmark Battle for Workers' Rights at Wal-Mart

by Liza Featherstone

Basic Books, 282 pp., $25.00

Nickel and Dimed: On (Not) Getting By in America

by Barbara Ehrenreich

Owl, 221 pp., $13.00 (paper)

Betty Dukes, Patricia Surgeson, Cleo Page et al., Plaintiff, vs. Wal-Mart Stores Inc., Defendant: Declarations in Support of PlaintiffsUnited States District Court, Northern District of California, at www.walmartclass.com

Everyday Low Wages: The Hidden Price We All Pay for Wal-Mart a report by the Democratic Staff of the House Committee on Education and the Workforce February 16, 2004, at www.edworkforce.house.gov/democrats/walmartreport.pdf

1.

Throughout the recent history of American capitalism there has always been one giant corporation whose size dwarfs that of all others, and whose power conveys to the world the strength and confidence of American capitalism itself. At mid-century General Motors was the undisputed occupant of this corporate throne. But from the late 1970s onward GM shrank in the face of superior Japanese competition and from having outsourced the manufacture of many car components to independent suppliers. By the millennium GM was struggling to maintain its lead over Ford, its longstanding rival.

With the technology boom of the 1990s, the business press began writing about Microsoft as if it were GM's rightful heir as the dominant American corporation. But despite its worldwide monopoly as the provider of software for personal computers, Microsoft has lacked the essential qualification of size. In Fortune's 2004 listings of the largest US corporations, Microsoft ranks a mere forty-sixth, behind such falling stars as AT&T and J.C. Penney. However, Fortune's 2004 rankings also reveal the clear successor to GM, Wal-Mart. In 2003 Wal-Mart was also Fortune's "most admired company."[1]

...

|